Loan Officer Hub blog

Stay informed with leading insights

Interested in increasing your knowledge of mortgage industry trends and strategies? The Loan Officer Hub blog gathers insights from around the industry, curated just for loan officers. Filter by strategy for the content you need to help you boost your business in the areas of working with referral partners or consumers, improving your marketing or optimizing your business.

-

Finish 2025 strong. Own 2026.

The preparation for your best year ever in 2026 starts right now! Here are 5 key concepts to help you finish 2025 strong and put yourself in the best position for 2026.

-

Why you’re not making more money – and what to do about it

If you want to make more money as a loan originator, invest your time in high-impact relationships.

-

Housewarming gift ideas for loan officers

A gift at closing can be a nice way to welcome borrowers to their new home and contribute to a lasting impression that can lead to referrals.

-

3 lessons from a 20-year mortgage career

Jeremy Engle shares these key lessons he learned over the course of his career in loan origination: Be ready to pivot; be a problem-solver; and focus on service.

-

Why every loan officer should know their client avatars

A client avatar helps you understand the full picture of the client: who they are, what their life looks like, what they know (and what they don’t), and the concerns they may not even say out loud.

-

Why accountability is the loan officer’s secret weapon

When you have someone holding you accountable every week, something powerful happens. You stop making excuses and start making progress.

-

The next-gen originator is powered by AI

AI is here to stay, so how can you make the most of it as a loan officer? Dustin Owen of The Loan Officer Podcast shares his tips.

-

How to generate real estate agent referrals like the top 1% of mortgage professionals

Geoff Zimpfer shares the referral tips he's gleaned from over 300 interviews with top producing loan officers.

-

The mortgage industry’s best-kept secret: How education, common interests and the law of reciprocity can transform your lead generation

The key to your success as a loan officer is in your passion, your knowledge, and the connections you already have.

-

How consistency, client education, and systems drive success in the mortgage industry

Shane Kidwell describes 6 key strategies that can help loan officers elevate a mortgage business.

-

The evolution of divorce mortgage planning: From simple loan origination to comprehensive financial strategy

Judy Bruns outlines how loan officers can become advisors who provide more comprehensive financial solutions for divorcing homeowners.

-

3 key mindset adjustments for loan originators

Adopt a growth mindset, focus on process over outcome, and understand the difference between motivation and drive!

-

Get out there IRL: Mortgage is still a face-to-face business

Diego shares how he grew his business by being physically present in his community and building relationships that help business come to him organically.

-

4 takeaways for loan officers from the June Mastermind Summit

Get insights about the NAR settlement, why originators need to get back to basics, the importance of video and more.

-

From likes to leads: Mastering TikTok as a loan officer

Learn how this originator uses TikTok to generate the majority of her leads – and how she plans to pivot to other platforms if necessary.

-

Content to close: Why and how to embrace social media as a loan officer

Do you know how your digital resume stacks up? Kayla provides her tips for building trust online.

-

6 credit tips for loan officers to use with borrowers

Get answers to frequently asked questions about credit scores and credit reporting.

-

Unlocking success in 2024: 5 powerful end-of-year business planning tips

Strategies from Ron Vaimberg to help loan officers clarify their goals and create an action plan to achieve them.

-

Leveraging AI: 5 ways loan officers use AI for marketing

Learn how progressive loan officers are harnessing the potential of artificial intelligence to gain a competitive edge.

-

3 secrets to surviving an economic storm

Prepare now so you’re strategically positioned to thrive.

-

How loan officers can get started working with referral partners

Get 4 referral tips from a top originator.

-

Jump-start your 2023 planning with insights from fellow loan officers

Learn from your peers: Get our takeaways on business planning from the most recent Loan Originators Survey.

-

Go back to the basics to help more renters become homeowners

Build your pipeline by seeking out potential clients who may not know if they’re ready to buy a home.

-

How loan officers can turn human resources departments into referral partners

With a growing focus on employee financial wellness, loan officers have the opportunity to partner with HR departments to offer free educational sessions on the path to homeownership.

-

Establish your network by being a part of your community

People want to work with those they know, like and trust. Build your community rapport by being a connector and working in partnership with others.

-

Increase your lending impact by assisting a new generation of homebuyers

5 lessons for loan officers looking to serve more diverse communities.

-

Creative strategies to use with move-up buyers

More experienced borrowers face their own obstacles – and often need advice from a savvy loan officer to help them achieve their goals.

-

How Joanna Garcia realized her own American Dream by helping her Cuban community realize theirs

US Bank loan officer Joanna Garcia has found her niche – and great success – helping her Hispanic community buy homes.

-

Master social media with 5 visibility-boosting tips for loan officers

Discover how to take advantage of the power of social media to generate leads and referrals with these strategies to magnify your presence.

-

How to skyrocket referrals from your borrowers

Make sure you have the right systems in place before, during, and after the loan process to maximize customer referrals. Here’s how.

-

5 steps to create and execute a business plan as a loan officer

Business planning gives you a path to success and a goal at the end – without a goal, you’re just going to work every day.

-

3 tips for loan officers to finish the year strong

The year is rapidly coming to a close. Are you set to finish the year strong?

-

5 ways to embrace and improve at marketing yourself through video

Ready to start marketing yourself on social media via video? Here are 5 tips to take your videos to the next level.

-

How to help borrowers overcome a low appraisal

If an appraisal comes in under the offer price, how can a lender help a borrower overcome that hurdle? Here's one solution.

-

3 ways top loan officers connect with real estate agents

In a recent survey, 96% of top originators said that real estate agents are one of their best sources for generating referrals.

-

How to talk about down payment assistance with borrowers and real estate agents

Demand for DPA programs is at a record high. Why do loan officers balk at taking advantage of these opportunities?

-

The surprising way to avoid burnout AND win bidding wars

Experiencing burnout? It’s time to change the story you’re telling yourself about what you need to do in your business and why you need to do it!

-

5 strategies that help loan officers work more efficiently to manage high origination volume

2021 is going to be another unique and challenging year. Is your business ready for a shift?

-

How to avoid mortgage loan officer burnout

Learn how to reduce burnout while also bringing the most value to the most people in the least amount of time.

-

Leverage closing to build relationships, strengthen brand, generate referrals

Make the most of your closing as a loan officer by leveraging the closing to build relationships, strengthen your brand and generate referrals.

-

3 ways loan officers can help speed up the underwriting process

Learn 3 simple ways loan officers can close more loans, faster, and be more organized while doing it.

-

3 ways lenders can attract more Asian American & Pacific Islander (AAPI) homebuyers

There are three simple ways lenders can attract more Asian American & Pacific Islander homebuyers. CEO of The Mortgage Collaborative, Jim Park shares how!

-

Technology to grow a personal brand in the mortgage industry

These apps can help you get started growing your brand as a loan officer.

-

How to close more loans as the #1 financial expert in your market

Are you the hero, the villain or the guide in the story your clients and referral partners are telling themselves?

-

How loan officers grow business as financial planners to borrowers

It's clear how loan officers grow business as financial planners to borrowers, but first you have to know my background in the mortgage industry.

-

4 down payment assistance marketing strategies for loan officers

31% of millennial homebuyers are planning to use a first-time homebuyer assistance program to help with their down payment. Learn how to reach them.

-

How to turn your mortgage advice into a competitive advantage

As a loan officer, your mortgage advice can be a competitive advantage in helping borrowers realize their dreams of becoming a homeowner.

-

What baseball can teach us about loan production

There’s a fundamental element of baseball that can help loan officers become better sales professionals: the number 3.

-

How loan officers succeed in a cooling housing market

Transferring success from a hot market to a cool one isn't guaranteed!

-

Getting started with social media in the mortgage industry

Using social media for business can be daunting! Here are some easy tips on how you can use social media to increase your business growth.

-

4 ways to engage potential Hispanic homeowners all year long

Representing over $2 trillion in consumer buying power, the Hispanic homebuyer market is huge.

-

5 keys to originating successful construction loans

Consumer Construction-to-Permanent (CTP) loans are arguably a smart space for any loan originator. Follow these tips for successful construction loans.

-

Risk considerations in social media marketing within the mortgage industry

Social media is a powerful tool for business development within the mortgage industry, but we need to always be conscious of potential risks.

-

5 money smart tips to share with your mortgage borrowers

As a mortgage loan officer, you’re uniquely positioned to help your mortgage borrowers manage or eliminate their debt. Use these 5 money smart tips to set your mortgage borrowers on the path towards a debt-free future.

-

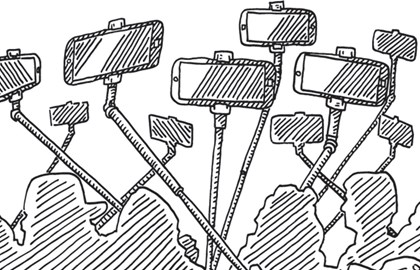

5 tips for taking better selfies with a selfie stick

Have a little fun with your referral partners the next time you see them at an event: take a selfie! Here are some key tips to take better selfies with a selfie stick.

-

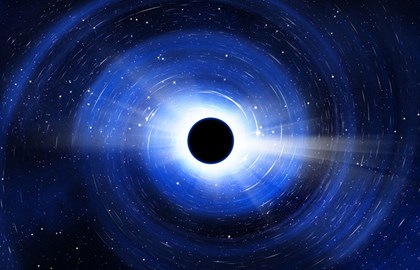

The solution to CFPB's TILA-RESPA Black Hole Issue is simple

The CFPB recently announced a fix for the so-called "Black Hole Issue," a byproduct of amendments to the TILA-RESPA Integrated Disclosure Form (TRID 2.0). See how this fix works in 5 different examples.

-

How to stand out as a mortgage expert on social media

Follow these expert tips to make sure you get noticed on social media and then convert that attention to more business.

-

3 questions to ask Realtors to strengthen relationships

Have a meeting with a real estate agent but aren't quite sure what you want to say? Ask these 3 simple questions to strengthen your relationship every time you meet.

-

Mortgage expert insights on business planning strategies

Learn how to plan a successful business strategy with these mortgage expert insights from influencers, top producing loan officers and real estate experts.

-

Insights for young mortgage professionals from MBA CEO David Stevens

David Stevens offers insights and advice to young mortgage professionals in this exclusive in-depth conversation.

-

3 things loan officers still have wrong about Millennials

Discover the truth about Millennials by correcting three common misconceptions about the largest living generation.

-

The loan officer's incredible opportunity with (the neglected) Generation X

Generation X is the "forgotten middle child" of the mortgage industry. Learn how loan officers can boost their business by focusing on this generation.

-

3 things loan officers should know about baby boomers

Don't let the hype of Millennials and Generation X in the mortgage industry distract you from the many opportunities that Baby Boomers present.

-

7 expert tips for working remotely as a loan officer

Up your at-home game with expert tips about working remotely as a loan officer, straight from top loan officers in the mortgage & housing industry.

-

How to be a first-time homebuyer's best friend

First-time homebuyers have become my bread-and-butter, so to speak. Here's how I have become a first-time homebuyer's best friend.

-

8 benefits construction-to-perm lending provides to the mortgage professional

Mortgage professionals need to realize the perfect storm has formed, and the time to get into construction-to-perm lending is now.

-

7 ways to effectively talk to Millennials about mortgage interest rates

Millennials are now the largest living generation in America. Learn how to talk to them about home buying and mortgage interest rates.

-

Money-making strategies for loan officers

The bottom line is always front-and-center for truly competitive loan officers in the mortgage industry. Here are a few key money-making strategies to try.

-

Ways loan officers can help Hispanic Millennial homebuyers

Hispanic Millennial homebuyers are set to be a dominant force in the mortgage industry. Here are a few key ways you can help this demographic.

-

The secret all top loan officers know

Top loan officers have one thing in common that allow them to maximize their opportunities and generate more business. Do you know what it is?

-

5 strategies loan officers use to attract more business

To keep your business healthy, you need a steady flow of new and repeat customers coming through your door. So how can you attract more business?

-

Tag! You're it. Simple social media marketing for loan officers

Social media marketing for loan officers is an key part of any online strategy to create more business opportunities, especially with first-time homebuyers.

-

Social media secrets for the savvy loan officer

Let's discuss some of the social media secrets loan officers are using to expand their customer base without a significant time investment.

-

3 Twitter secrets that don't require you to tweet

Instead of tweeting, try using Twitter as a listening tool in the mortgage industry.

-

Want to close more loans? Help borrowers find financial stability

You're in the perfect position to educate first-time homebuyers on how financial stability will help them achieve sustainable, successful homeownership.

-

7 ways to optimize referral sources for loan officers

Expanding referral sources for loan officers means being open to new ways of increasing your presence with key referral partners. Here are a few examples.

-

4 ways a loan officer can work better with real estate agents

Here are 4 tips to help you build a foundation and improve your interactions with real estate agents, as well as help you stand out from the competition.

-

4 great ways to annoy your LinkedIn connections

LinkedIn is where professionals go to connect — think of it as a modern-day business card. That’s why it’s important to act professional.

Subscribe to Loan Officer Hub

Never miss a key insight, tool or strategy! Loan Officer Hub is here to help you succeed in the mortgage industry. Subscribe to our email newsletter to be notified when we drop the latest content from industry experts.